2023 was our first full year of not working. After a few false starts, it was also the year we relocated to a much wilder part of the UK.

It has taken me a while to sit down and finish this, as we’ve had a run of wonderful dry weather here in SW Scotland, and I always find it hard to motivate myself to be inside when it is dry and sunny outside (if a bit chilly). Storm Isha has brought a run of over 2 weeks to an end in spectacular style, and sitting in front of the fire while rain lashes the windows and and there is a howling gale outside, seemed a good time to finish this post. Unfortunately a 18 hour power cut followed by a 4G outage almost immediately afterwards (what our internet connection is powered by) has delayed actually publishing it! Well I did say we wanted to be somewhere more wild……..

When I first started writing this blog back in the summer of 2020, we had just hit our FIRE number, and had a vague plan to ‘move somewhere more rural one day’. Having just seen our Freedom Fund hit it’s target in Dec 19, before almost immediately plummeting in value at the start of the Covid pandemic, we were a little wary of the sequence of returns risk as well as not having a clear plan. I did what seems to almost be a rite of passage in the FIRE community – I waited one more year. In Spring 2021, I managed to negotiate a fantastic part time deal with my employer (semi-retirement at 43), which allowed me more time to figure out what I wanted long term. It also meant I had a transition period from full time work, rather than making a sudden, huge, lifestyle change.

Having worked 50% of my time for a year, it became clear that I was not going to get bored, or run out of things to do without work in my life, so I took a deep breath and handed in my notice. With the benefit of 50% of our time as our own, we had also had the opportunity to explore more rural parts of the UK in a relaxed way, so see what felt right. The exodus from cities during the pandemic had driven rural property prices up across the board. Some areas that we had been considering, were no longer affordable for the kind of set up we were after.

In July 2022, I completed what is likely to be my last ever day in the office. We also sold and moved out of our home in Cambridgeshire, at what turned out to be the peak of the market. We had been seduced by the wildness, wildlife and simpler lifestyle that South West Scotland offered. As the Scottish property system is different from England, it was simplest to sell our house and break the chain, before committing to anything north of the border. We had the campervan, so decided to sell many of our belongings and put the remainder in a storage container, before embarking on a nomadic summer adventure. We didn’t expect this adventure to last over a year in the end.

Subsidising accommodation costs with house sitting proved to be much more rewarding than we could have imagined when we tentatively set up our profile online. It presented a number of opportunities to travel the country almost for free and avoid having to spend the winter in the van – although I suspect that drafty old Hall in Suffolk in Dec 22 was much colder than the van would have been!

2023 rolled round and we were starting to tire of the nomadic lifestyle. The novelty of the adventure had worn off and we were starting to struggle with not being able to do many of the things we enjoy. The equipment needed was either packed up in storage or we just never knew where we would be from one week to the next, so it was impossible to make plans too far in advance. With no sign of the right property coming on the market after a previous deal fell through, we decided to look for a rental in the right area as a base to make house hunting easier. With rising interest rates, the cash from our property sale was making more than enough to cover the additional cost, without draining the freedom fund.

Unfortunately, we quickly discovered that the housing crisis gripping the country seemed to be particularly severe in the area we wanted to be. Although rent was very affordable, there was just nothing available. It took us until the beginning of May to actually be accepted as tenants, and even then we were nearly an hour from where we ideally wanted to be, and the house was noisy, being on a busy road in a town. Not really our style, but beggars can’t be choosers. Despite now having a base, we continued to house sit when particularly attractive opportunities arose.

We made the most of the amenities on our doorstep, and in fact we still make occasional trips back to stock up on favourite items from small independent shops on the high street. Of course almost as soon as we moved into a rental, a property came on the market that was almost ideal for us. Being just up the road, we were able to view the same day. Having missed out before, we didn’t want to hang around, so used our chain-free cash buyer status to negotiate quickly in an uncertain market. Less than 24hrs later we had an offer accepted.

Conveyancing didn’t quite run smoothly (does it ever?), but despite a few hiccups, we got the keys in the middle of September. We finally completed our planned move, 4 years after hitting our FIRE number, so not exactly a swift transition, but looking back, I think the only part I would change is having to rent somewhere for 6 months. It would have been nice to have completed the purchase of the original property, and been installed in the spring. That said, I think the house we ended up in probably suits us better, and the extra cash in the bank is definitely nice to have as an extra buffer.

As we had already committed to a couple of repeat house sits, and because we planned to move ourselves this time, we didn’t immediately give notice on our rental cottage. We moved our belongings across slowly – in mostly monsoon conditions 🙄

It took us a while to feel at home in the house itself, but immediately took to the landscape around us. We wanted a project property, and were expecting a cold first winter in a house with an EPC rating so poor, it was only just on the scale. What we weren’t expecting, and what the home report should have picked up, was the damp in two small downstairs rooms. They are rooms we were planning to use as a spare bedroom and study, so less disruptive than if it had been the kitchen or living room, but still not ideal. After much research and a steep learning curve, we are now more comfortable with what it will take to improve the situation, and do the right thing by the almost 300 year old original part of the building. We were going to have to make a big mess to improve the insulation anyway, now we know we need to use traditional, vapour permeable materials when we do so.

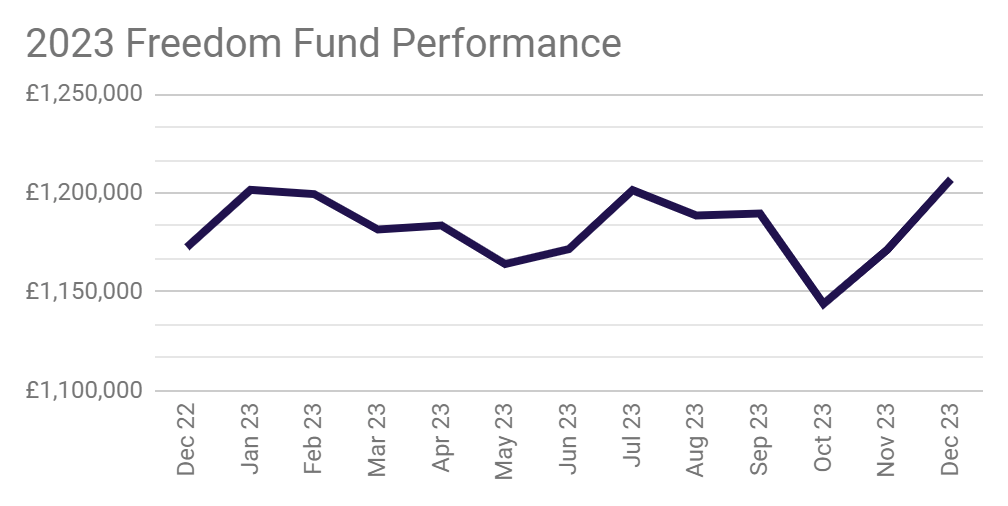

At the end of the year, the annual stats looked like this:

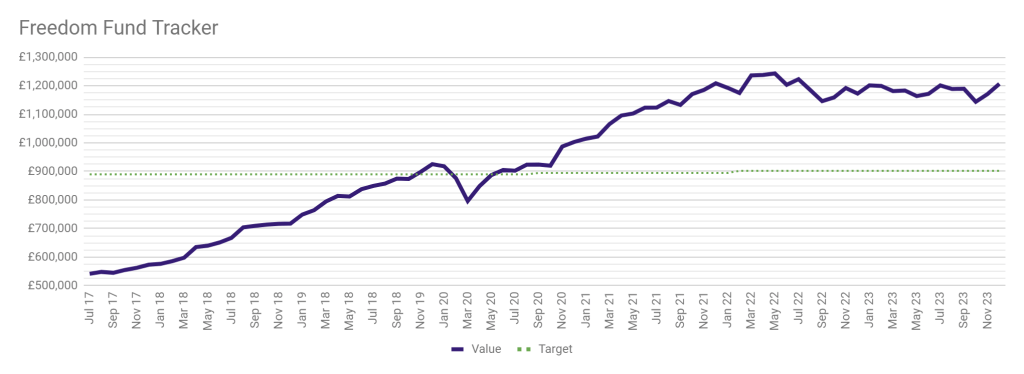

We finish 2023 in a very different situation from where we started it from a lifestyle point of view, but the Freedom Fund value hasn’t changed much at all. Overall, it ended the year up almost 3% on Dec 2022, recovering after a dip in October.

- Freedom Fund value at the end of Dec 2023 – £1,208,946 (up £34,360 on end Dec 2022)😐

- Annual withdrawal rate – 3.44% 🙂

- Income earned in 2023 – £5,324🙂

- Books read – 18 (vs target of 24) ☹️

- Miles walked – 1,673 (vs target of 1,748)😐

As you would expect, there were monthly ups and downs, but overall the value was pretty flat.

Zooming out, shows the value has been fairly flat since we started to draw from it in the summer of 2022.

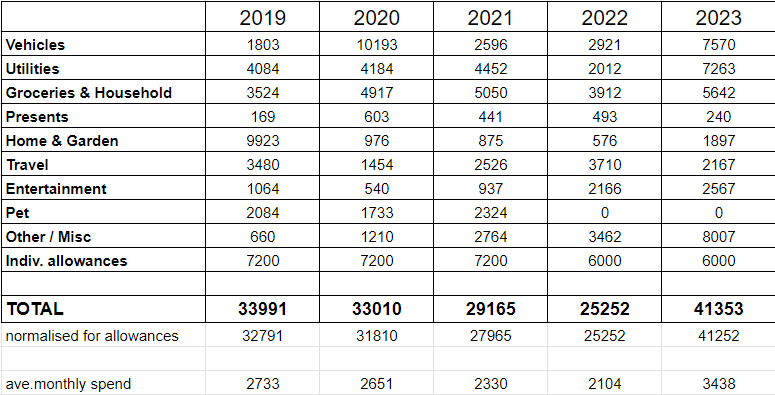

Our expenses in 2023 were significantly up on the previous year. I knew this would be the case, but it still totalled more than I had expected at £41,353.

I am still not sure what level of monthly spending will be ‘normal’ in 2024, but it should be less than the £3438 we averaged in 2023. Despite much higher spending,this represents a 3.4% withdrawal rate for the year, which although higher than I would like, should be sustainable.

Inflation has definitely had an effect, especially in the groceries and entertainment lines, and possibly also the misc line. Utilities are up significantly, mainly because we only paid for them for half of 2022, and in 2023 this line includes almost £4k of rent. Vehicle costs are also up sharply on the previous year, mainly due to some major repairs to the van and getting the sports car back on the road, but also due to increased fuel usage and the inflation of diesel costs. I should also mention that in 2022, I included the proceeds from a car sale in this line (£1500) making it artificially low.

The uptick in home and garden spending is entirely due to the last few months of the year in the new house, and this will continue into 2024. Once we get started on the renovations in earnest, this line will definitely increase a lot further. I will keep track of renovation costs separately from normal home maintenance & garden spending.

Earned income in 2023 totalled £5,324 from coaching and mentoring, a couple of small mystery shopper jobs and a few paid surveys. Right now, I expect this to reduce a lot in 2024, as I have no ongoing or planned coaching and mentoring work. That said, who knows what opportunities may arise in 2024 that we might want to pursue. We are fortunate that any paid work we take on will be because we want to, not because we have to.

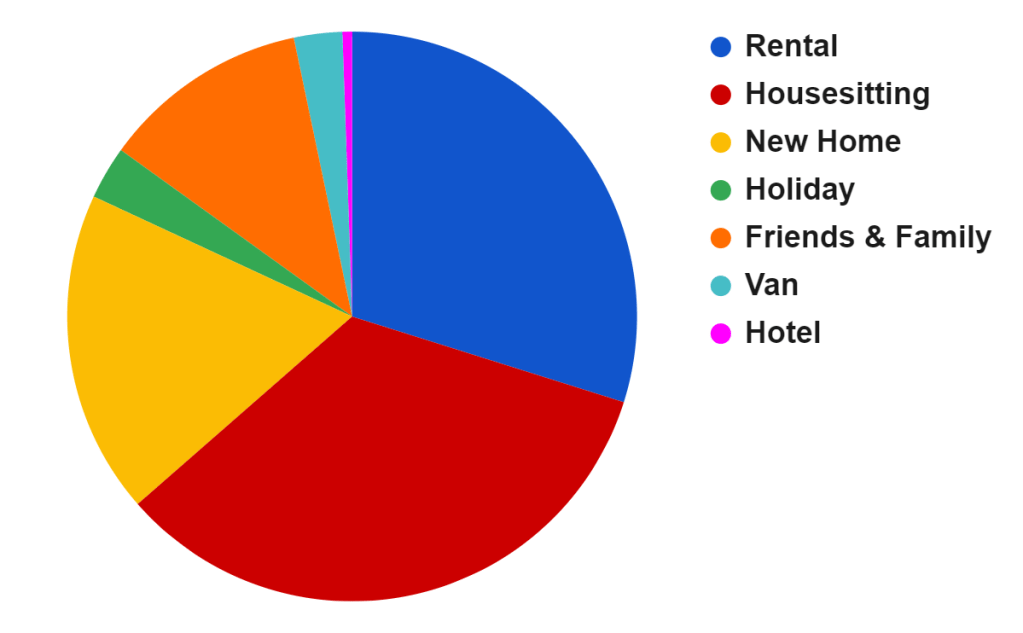

I don’t anticipate that this time next year I will be quantifying where we spent the year, as mostly it will be in our new home. Looking at where we stayed in 2023 gives a very mixed picture. I would have guessed that the rental house would come out on top, but actually we spent 14 more nights housesitting than in the rental cottage. Memory is always biased to more recent experiences (why writing appraisals is so hard if you haven’t kept notes through the year). When I actually looked at the numbers, the fact we didn’t have the rental available until the beginning of May, and then continued to do (mostly repeat) house sits once we had moved in, meant the reality was a bit different.

I was also surprised how many days we spent with friends and family. This was driven by the Covid imposed isolation with my in-laws for 2 weeks in January, additional time spend with my parents helping them de-clutter ahead of their house sale and the havoc our van breaking down caused for 5 weeks in April & May. Apart from the Covid incident over Christmas and New Year 23, we stuck to our rule of never staying with friends or family for more than a week while they were home. With limited accommodation options, we didn’t want to risk falling out with anyone! I think going forwards, we will be focussing more on making sure we spend enough time visiting friends and family, now we are that much further away.

In case you are wondering, the couple of hotel nights were when travelling up to get the keys for the rental house (£26 Travelodge!) and a night in London for a funeral.

In 2023 we completed 10 house sits, 5 of those being repeat sits for friends or animals and houses we particularly liked. This included looking after 7 dogs, 2 cats, 22 chickens and a tortoise. I have really enjoyed looking back over the animals we looked after least year.

So what will 2024 bring? I have decided to stop counting time since Financial Independence in months. After 4 years that was getting a bit daft. Although it seems a long time ago I hit publish on that first post, it has also gone past in a flash. I don’t know if I would have accomplished as much without monthly updates and goals to hold me accountable.

2024 goals. As well as continuing to monitor and document the value of the Freedom Fund, I want to shake up my monthly goals this year, now we will be a bit more settled. Walking every day has become such a habit, that will stop measuring it (but definitely keep doing it). One of the many attractions of this area was the outdoor swimming opportunities, both sea and freshwater, so this is were I want to focus in 2024 for a physical activity related goal. I also want to get better at recognising and using the wild ingredients all around us in our new home. Finally, and I don’t know quite how this will evolve, but I want to document the work we do on the house and the traditional materials and skills we learn along the way doing most of it ourselves. I expect there will be more to write some months than others, but I want to hold myself accountable to making a start on writing something that documents the specific trials and tribulations – and achievements. Maybe I’ll end up publishing something, or maybe it’ll just be a record for me. Time will tell.

- Foraging – learn more about the wild edibles in our new area – forage something each month

- Wild swim once a month minimum, in as many different places as possible!

- Document our house renovation project in an illustrated journal each month

What are your goals for 2024? It’s amazing how much you can achieve in a year if you put your mind to it.

I was going to include a few photo highlights of the year at the end, but unfortunately our internet connection remains a bit flaky. I am just hoping everything else uploads ok…….

Fantastic update. Thank you for sharing and good luck with the renovations!

LikeLike

Nice update with lots of numbers too.

OOI, vs CPIH your freedom fund (minus earned income) over 2023 went down by about 1.3% – which is not bad given that: a) you have been drawing on it all year; b) your expenses increased; and c) you may not earn as much income in 2024. IMO whilst it is very useful to track the nominal value it can be a good idea to keep an eye on how you are doing versus your chosen flavour of inflation.

Looking forward to reading about your forthcoming renovations.

LikeLiked by 1 person