I can’t believe it is a month already since my last post, it seems to have passed in a flash. November brought the first frosts in East Anglia and some lovely crisp mornings for pre-work walks at the start of the month. The second half of the month was pretty much all travelling round the country for family birthday celebrations and catching up with some school friends who I hadn’t seen for over 2 years, because of, well, you know why…….

We had a lovely time, but are now glad to be home for a few days before heading off again to visit some other friends on the coast that we haven’t seen for….well, I think you can guess roughly how long.

Our travels this month have once again found us out in a more rural landscape, and again reinforced that this is where we want to be longer term. We have a few trips lined up in the spring to explore areas we are less familiar with, where we could afford a bit of land. Hopefully

that will help us to narrow down geographically on where we want to be. We have also agreed to use our extended Christmas break to get a few jobs done around the house and get it valued in the spring. That will then coincide with the anniversary of me going part time, and it will be time to make some decisions!

Last month, I was finding work quite stressful with increased demand for my time and skills, and not enough working hours to fit in everything I knew was needed to do a good job. Coming off the back of 2 non-working weeks, I am feeling better about this, but looking ahead to 2022 and planning my working / non-working schedule, I can already see conflicts. If I plan to be working for all the events and busy periods colleagues want me to be available to support, I will be up to 75% not 50% working. Something is going to have to give.

With the discovery of the new virus variant, the value of the freedom fund has seen quite a lot of volatility since last month, starting with yet more record highs and ending up at a pretty similar level to last month on a like for like basis.

The actual numbers below look a little higher, as we have decided to expand the scope of what is included in the freedom fund this month and going forwards. We have separate cash ‘savings’, which we have always thought of as ‘plan to spend’ accounts rather than savings accounts. These are allocated for vehicles (depreciation as well as maintenance & running costs) and a more general home improvement / travel pot. Over the last couple of years, the balance in the latter of these accounts has risen beyond what we would reasonably expect to spend. Historically it has typically sat at around £1-5k and is currently sitting at almost £15k. As this is broadly discretionary spending, we have decided to include this in the cash portion of the freedom fund going forwards. As we have a lot of decisions to make in the first half of next year, we are definitely erring on the side of keeping more in accessible cash than we have in the past.

So what does all this mean for the monthly numbers? I have shown 2 figures this month both including and excluding the extra cash balance, for comparison. Going forwards I will only include the new calculation.

Freedom Fund Value: £1,185,713 (£1,170,795 without extra cash)

Hypothetical monthly income @4% SWR: £3,952 (£3,903 without extra cash)

Actual monthly expenses: £2003*

Finally, our monthly expenses have returned to something more like ‘normal’, despite a lot of eating and drinking out and takeaways in November whilst catching up with family and friends. We made good use of our National Trust membership while we were away, which helped to keep entertainment costs to a minimum. We haven’t really done much Christmas shopping, but with small families and taking a secret Santa approach for adults, this is never a huge expense for us. Mr W and I have agreed to buy ourselves half a new toaster each….I know…rock and roll or what! Our current toaster was bought when we first moved in together, and as we have just celebrated our 15th wedding anniversary (with fish and chips and prosecco), we thought it was about time we finally stopped making do with increasingly patchy toast. We plan to buy something good quality that will last us another 15+ years, but you never really know.

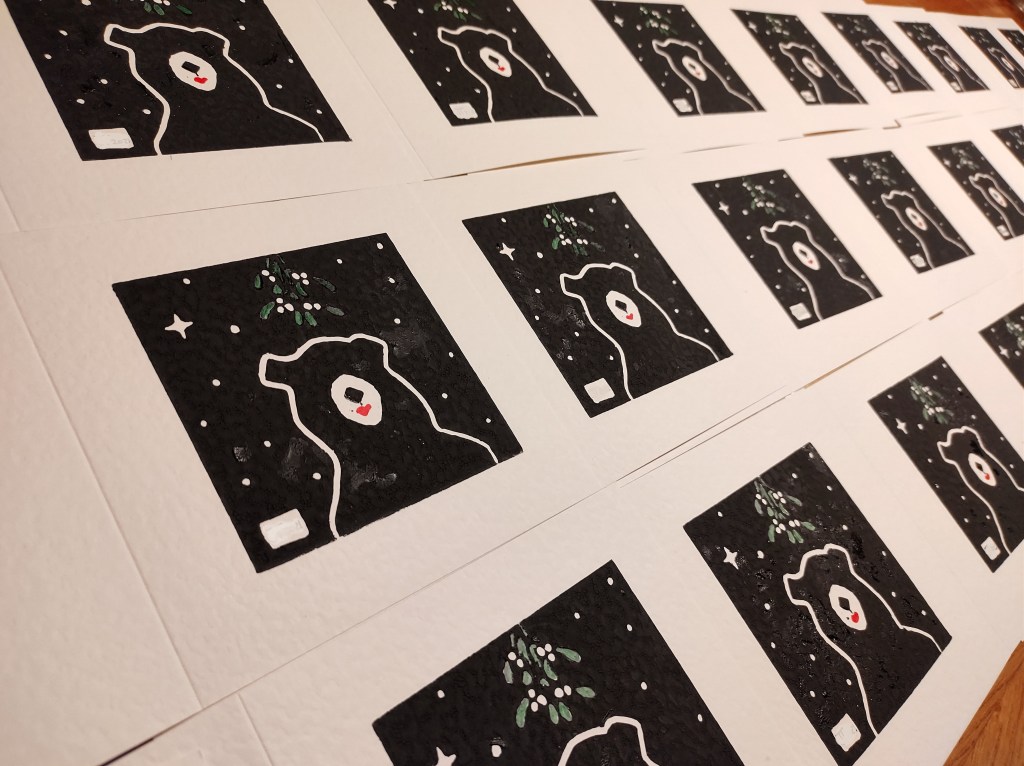

I have also had my craft materials out again to use up the last of the blank cards from last year to make a new very limited edition of Christmas cards for the few people I still send them to. Whatever you have planned for the festive period, I hope you manage to include what makes you happy and cut out the obligations which don’t.

Fantastic update. Have been reading for some time and really enjoy the write ups. I am also keen to see where you decide to move and what type of life you see for yourselves long term.

An exciting journey ahead.

LikeLike

Thanks for taking the time to comment. It’s hard to know if I’m on the right track and writing anything of interest sometimes 🙂

LikeLike

I hope you do not mind me saying, but you seem a lot less optimistic in this post about your revised working arrangement.

Whilst there were some hints of this in a few of your earlier posts I just put them down to teething trouble.

Has something significant changed recently or are things just not working out as you had hoped for?

LikeLike

Without being too specific, when I changed my hours, my proposal was based on taking the saved half of my salary and recruiting a junior who could do the more admin side of my role. Over the last 6 months or so, the remaining part if my role (that a junior can’t do), has expanded. This is a great thing for the business, and if I were working full time, I would be delighted. If I were assessing my options a year ago and this was the situation, I think I would have been looking at other options to re- allocate half of my workload. I have some thoughts and have sent some of them to my boss ahead of our next 1:1. I think something needs to change going forwards, but I am not yet sure if this means full ‘retirement’ for me, a different part time role in the same business or something else. Rest assured, I will continue to write about it as I figure it out 🙂

LikeLike

So more like “growing pains” than “teething troubles”.

More often that not it is things (good and/or bad) outside of your direct control – or even your influence – that bring the challenges!

Best of luck and I am sure you will figure it al out.

LikeLike