July marked one year since I last spent a day in the office, and one year since we moved out of our home in the East of England. We have certainly had an adventure since then, and have no regrets whatsoever about packing in a conventional 9-5 type lifestyle. When I sat down to write this, I thought not too much had happened in July, but looking through the photos on my phone, we have actually done quite a lot! It’s amazing what you have time for when you don’t have to spend 8+ hours a day working for someone else.

The last month has been a nice balance of travelling and catching up with friends and getting out and about near home. When we got back after our Yorkshire housesit at the start of the month, we had a little over a week at home before heading down to Tatton Park for the flower show. Colleagues at my last job had a tradition of clubbing together for birthdays. Knowing my interest in growing things, I was given a voucher for RHS show tickets for my last birthday gift before leaving. I didn’t fancy trekking down to London for Chelsea or Hampton Court palace shows, so opted for Tatton Park near Manchester. The voucher was quite generous, so I bought 4 tickets and invited some friends. We made a weekend of it, booking a nearby holiday cottage for 3 nights.

The show made a nice change. I am not sure I would have paid almost £30 a ticket, but there were show gardens and a lot of small businesses and nurseries which very imaginative displays which gave us lots of creative ideas for when we finally have some outside space to call our own again. The change in focus from regimented immaculate rows of non-native species to more informal, wildlife friendly spaces was clear since my last visit to Chelsea 8 years ago. Or perhaps it’s just not Chelsea.

It was lovely to catch up with our friends in person for the first time in over a year, but it was obvious how our priorities had diverged since the last time we spent a lot of time together. Their lives focus almost entirely on work, with little time for anything else. When discussion turned to interest rates, they commented that they hoped they would drop again before their renewal is due in 2026 and I said they could make a concerted effort to pay it off by then, and sarcastic laughing was the response. I shied away from further probing. I don’t know their financial position, but one of them has a job with ‘Director’ in the title for a bank in the city. They don’t have children, and their home is modest, not in London and purchased 17 years ago. I don’t know if they are just of the mindset that mortgages are not something you get rid of quickly or they have rolled a lot of debt into their mortgage over the years, but I certainly didn’t feel that I could discuss the topic further, so just said something vague like “you’d be surprised how quickly overpayments can snowball”. It is a shame talking about money is such a taboo topic. I feared I might come across and smug or preachy if I broached the subject from the position I am now in.

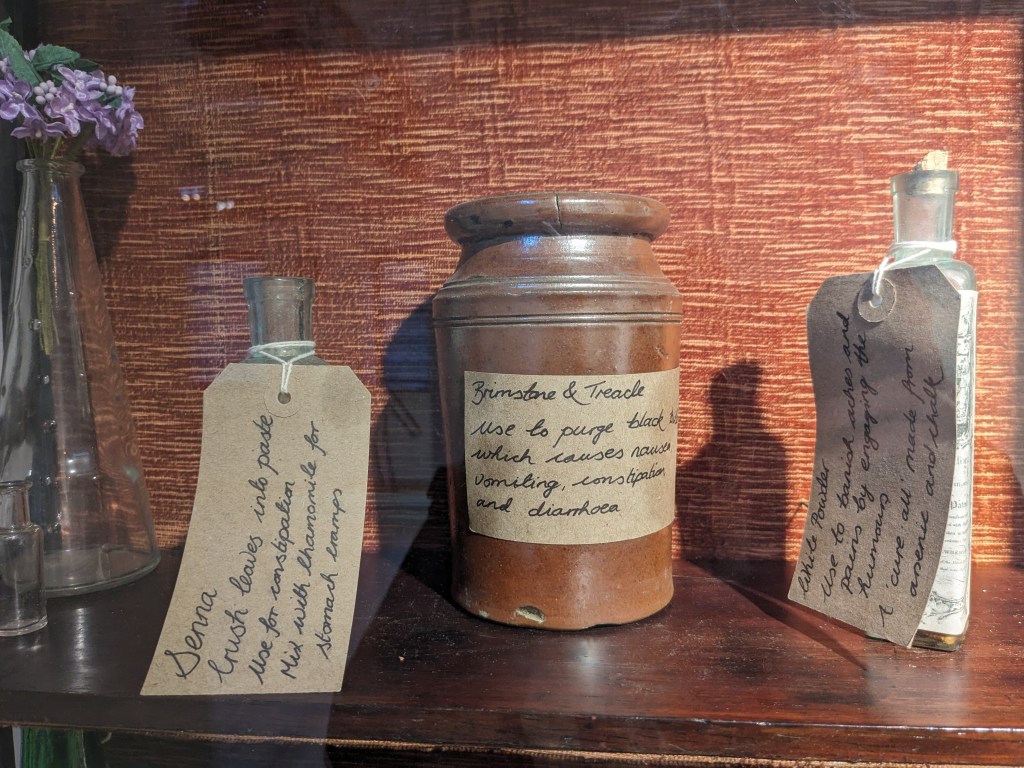

We do share an interest in visiting National Trust properties, so it was lucky that there were 2 in close proximity to our cottage, including the impressive Quarry Bank. If you have never been, it is a cotton mill museum with many working machines running (noisily) and a lot of interesting history. My personal favourite was the array of rudimentary (and in some case down right toxic) remedies for sick and injured workers. Zoom in on the photo of old labelled bottles in the gallery at the end of this post.

Of all the things we got up to back home north of the border, having a go at dry stone walling was a highlight. We spotted advertising for a demonstration of ‘drystane dyking’ (Scottish dry stone walling) at a local nature reserve, where all were invited to take part. The project was to build a circular viewpoint feature on a hill in the reserve over 2 days. There were people from SW Scotland and Cumbria dyking associations and volunteers with varied levels of expertise. I think we were the only total beginners. Newbies were paired with experienced dykers to build different sections.

We went for 1 of the 2 days and learnt a lot from some very knowledgeable people, and enjoyed some very good home made cake😋. Assuming our property purchase goes through OK, we will have a few drystane dykes to maintain, so we relished the chance to benefit from years of experience. One of the things we learned were how many styles of drystone wall there are. From the photos we showed them, the dykes at our new property were identified as probably ‘single boulder’ granite, a more agricultural style. What we were building was a ‘Galloway double dyke’. Who knew it was so complicated? We are now noticing all the different variations as we travel around the country.

We enjoyed seeing loads of newly emerged butterflies, and despite the decidedly un-summery weather this month, the weather rarely seemed too awful, as we have the luxury of being able to time our outings with breaks in the showers.

While we were out trying lots of new things, our money was quietly working away too. As well as being a good month for the freedom fund, increasing interest rates mean the lump sum from our house sale is now earning around £200 more each month than our rent and utilities is costing. This cash isn’t included in the freedom fund total, but once we have completed our purchase, we are expecting to have a little left over after allowing for work we will want to do, so we may chose to invest it as part of the freedom fund.

- Freedom Fund Value: £1,201,377 (up £29k on last month)

- Monthly expenses: £2,977* or a withdrawal rate or 3% if we were to maintain this rate of spending

- Earned Income: £1260

- Miles walked: 132 vs. a target of 146**

- Books read: 12 vs a target of 14 (2 per month)

The Freedom fund made some good gains this month, reaching a level not seen since February. We are currently withdrawing £2300 a month from it, with the balance of spending coming from interest from the ‘house pot’ of cash we have temporarily until our purchase goes completes.

Expenses this month were at a level I think is probably going to be fairly typical while we are renting. There were one off expenses like a freesat recorder box, as we only have a satellite dish at our rented property and the broadband it’s quite up to frustration-free streaming. As it is unlikely we will have a good freeview signal (if at all) at our new rural home, this is something we will use in the future. We also booked tickets for a ‘how to sow a wildflower meadow’ workshop in October and to see Oppenheimer at the local community cinema later this month. I haven’t been to the cinema for several years, but I suspect £7 a ticket is very reasonable! The Tatton Park trip also brought with it a nice dinner out and quite a lot of incidental sandwich / tea and cake type expenses.

My coaching and mentoring invoices for May and June were paid at the end of July, giving us a further buffer for increased expenses while renting.

Once again, we missed the target for miles walked. I am not too bothered by this, as long as we continue to come fairly close. I am pretty sure that if I stopped monitoring, it would get worse still.

I read 2 novels from the library this month, but I haven’t made any progress catching up from the miss in May yet. My latest library book is on beekeeping and growing plants for pollinators, and Mr. Wombat has been reading up on ‘selecting and keeping chickens’, so the library is certainly coming in handy to build the foundations of new skills. I have also found the cookery book section helpful in finding inspiration for trying simple new recipes to avoid the cooking rut that it is so easy to fall into.

Our house purchase continues to move in the right direction. I am hoping we may even have a move in date this time next month 🤞 (I hope I haven’t just jinxed it). This update is a little late this month, as we spent a few days down in Norfolk helping my parents to declutter and deep clean ahead of putting their house on the market, and I forgot to take my laptop with me. They have been talking about moving nearer my brother for some time, but we were hoping we could get ourselves sorted before having to head down to get their bungalow ready for sale. It was quite an exhausting few days, both physically and mentally, but I’ll talk more about that next month.

Photos on my phone from July were quite varied. As well as the activities I have talked about, we visited two beaches, a small island only accessible at low tide with a unicursal labyrinth on it, a castle, and a local agricultural show. I made my first focaccia from scratch and grew asparagus from heritage seed saved from a housesit kitchen garden in the Scottish Borders (with permission). We even took part in a whale and dolphin watch on the Mull of Galloway, the most southern tip of Scotland.

Oh yes, we were also delighted to discover that our local garage appears to be staffed by spaniels…….

*Includes £500 per month personal allowances (£250 each), which may not be spent in the month, but which is not tracked. Some of it may show up in the freedom fund in the future, if savings build up and are invested.

** I completed my challenge to walk the equivalent of Lands End to John O’Groats and back in 2022. This is the longest overland distance between 2 points on the UK mainland or 1748 miles. In 2023 I want to maintain the 146 miles a month this required

Clearly a very eventful year – thanks for keeping us updated.

Have you given any thought to what you would like to achieve over the next few years?

P.S. nice photos again

LikeLike

We have lots of thoughts! I think the problem will be prioritise what first. When we embarked on this move the aim was to live ‘off grid’, which for us meant as close to energy self sufficient as possible. We are expecting that developing renewable energy generation and storage will be a process over time.

I expect other goals will also evolve over time, but will definitely include learning new skills, creative and wildlife projects, volunteering and maybe a remote learning degree (free in Scotland).

LikeLike