As 2025 rolled in, I started crunching the numbers on our second year of ‘retirement’ and reflected on the investment journey that got me here. September 2024 marked 10 years since I made my first investment, so it seems appropriate to consider what is possible in a decade as well as just what we’ve achieved in the last year. I should clarify that in September 2014, I wasn’t starting from zero. I had been contributing to corporate pensions since I started my first full time job in 2000 and I had made a minor investment in unit trusts in 2002, through a work-provided financial advisor, when I received a small inheritance from my grandmother. I was starting from just over that magic £100k level when I actually took an interest and added it all up. Technically this was not my first investment, but it was the first I had taken control of, and responsibility for and that felt daunting to say the least.

That first transaction happened in September, but I had been thinking about it and considering where to put it for about 2 months. It seems ridiculous now (especially with the relatively small sums involved), but the fear of getting it wrong was very real. I have always been a saver, from the first time I opened a junior savings account with Portman building society (remember them?). I was attracted by the free wildlife posters and calendars that came with opening the account. How easily swayed 8 year olds are 😆.

There was something addictive about seeing the number in my passbook grow every birthday and Christmas and later with pocket money, and eventually allowances and a few bigger jobs at home. I used to look forward to autumn as I could make a fortune from sweeping leaves off the steep drive in our rural garden as it was a job my dad hated. It all swelled the coffers. When I was 16, I got a part time job at the local pub, which supercharged my saving rate and I had much less time to spend it too! I worked there until I was 18, giving up just before A levels completely took over my life. By then, the saving habit was ingrained. I had worked really hard for that money, so I was reluctant to spend it frivolously. Investing was a scarier thing altogether, even for a 37 year old.

I was very fortunate when I started my first job after graduating in 2000 when a senior colleague took me under his wing and explained the importance of the early years of pension savings, and told me a story about someone he knew who retired before 50. This narrative fitted very nicely with my savings habit, and I started increasing my pension contribution a little every time I got a pay rise. My salary was far from huge in those days, but I always paid myself first each month, putting a little away into savings after every pay day, as well as the automatic pension saving. Investing came quite a lot later. I do wonder what might have been possible if I’d understood FIRE 14 years earlier……….

Still, £100k to where we are now in 10 years seems like pretty good progress. It certainly helped that Mr Wombat got onboard in 2017.

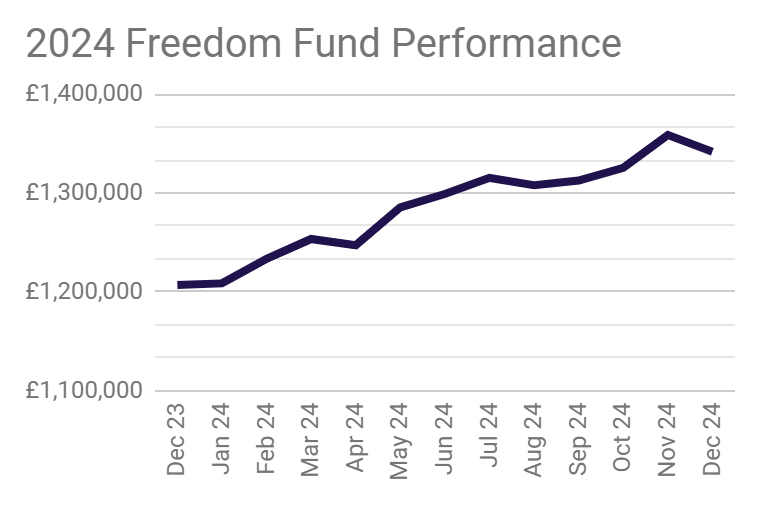

2024 was an incredible year for freedom fund growth, despite having not paid anything in since 2021, and drawing down our living expenses since the middle of 2022. Once that snowball gets rolling, the returns can be impressive. We ended 2024 11% up – or £134,742 better off than a year earlier. At the peak of my earning power (just before I went part time in 2021), I wasn’t earning this. So to be earning it for doing nothing is very gratifying.

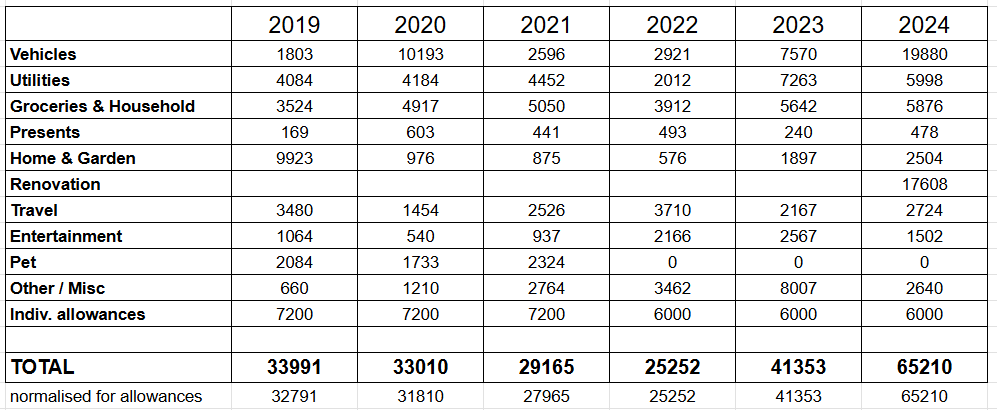

If we ‘earnt’ £134k, what did we spend? An astonishing £65,210! It was a very spendy year by our standards, but that did include buying a car and over £17k of house renovation spending. I discovered a couple of errors in my spreadsheet when tallying up the year. The below is definitely correct, but I suspect if you added up the expenses line in each monthly update in 2024, the two would not match. I can’t imagine anyone will be bothered to do that, so maybe no point in mentioning it.

Renovation spending comes out of a dedicated cash pot that is not included in the freedom fund total, as we intend to spend it. It is the difference between what we sold our house in Cambridgeshire for and what we spent on our new home in Scotland. We were fortunate that interest rates peaked just when we had it all in cash between permanent homes, and 5%+ interest on a significant cash pot gave the total a boost. With the housing market cooling, this was a good position to be in.

2024 saw us start to spend that pot down as we slowly got to work. As with any large savings pot, it was a difficult mental adjustment to go from watching it grow to pulling money out. We just have to keep reminding ourselves that this is what it was intended for. By doing much of the work ourselves, we will make it stretch as far as possible. I think that it is this approach that has been the foundation of our financial success. We always do the research to see if we can learn to do something ourselves before calling the professionals in. Sometimes we know we are out of our depth and it would be foolhardy to ‘have a go’. But this is a last resort. It means things happen more slowly, but when you don’t have a full time job to worry about, that’s OK. In many cases, we do a much more thorough and conscientious job than a ‘professional’ would do anyway.

If we don’t include one off renovation costs, we spent £47,602 in 2024. Still an increase on 2023, when we paid rent for 6 months. If we remove the cost of the car, this drops to £31,055. This looks far better, but also is not real, as we will need to buy a new car every so often. I think amortising the car cost over 5 years is probably fair. Assuming nothing goes drastically wrong, we will probably keep the car longer than this, but you never know. I just need to remember to add that line in to next years spending too.

By this measure our spending in 2024 was £34,345. Which seems reasonable, and hopefully sustainable at 2.56% withdrawal rate.

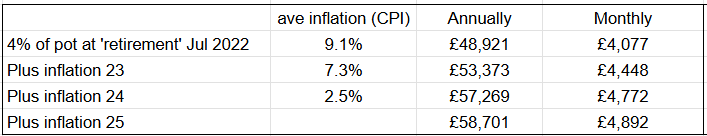

Since we started living off income from the freedom fund, I have been tracking what sticking rigidly to the 4% rule would have meant in terms of drawdown as a comparison. We chose not to go this way as we (hopefully) have a long retirement period to fund, and I wasn’t confident that a 4% withdrawal rate would be all that safe, depending on early years performance. If we had stuck to this mantra rigidly, we would have had more cash to spend: £57,269 in 2024.

This makes me feel more secure in our situation and better able to weather the inevitable next downturn, whenever that may be. Every year that goes by without a significant correction, decreases the sequence of returns risk for us.

I’ve never separated this out in annual reviews before, but the value of our ISAs on their own is something we keep an eye on. It is very relevant to our retirement timeline, as it is 10 years until I can access private pensions, and 20 years until I can access my state pension (if it’s not means tested by then). ISAs are our only source of income for now, so we need to ensure they don’t deplete too fast.

At the end of 2023, our combined ISA pots were worth £504,768. After a year of monthly withdrawals, that total stood at £523,718 at the end of 2024.

Last year they went up in value by more than we withdrew, which is fantastic. We withdraw what we need rather than a fixed number, and this year this represented 2.6% of the total freedom fund value, but 6.6% of the accessible ISA pot, so we have to expect that long term, it will deplete while the pensions continue to grow untouched (hopefully!).

2024 was an exceptional year, I don’t expect this to continue at the same rate, but I hope the value of our ISAs doesn’t start to drop at an alarming rate. I think we will both start to feel the pressure to generate an income if that starts to happen. I suspect we will earn in drips and drabs over the coming years, but I don’t want to feel the need to. Our new life works for us because it is based on autonomy and freedom to choose.

Overall 2024 was a pretty good year for us. Financially, everything looks sustainable. The house project made a slow but sure start, and we hope that will accelerate this year as we have more skills and confidence and a clearer plan. I had no funerals to attend in 2024, which was a huge improvement on 2023.

We had loads of visitors, which was lovely, but we are not sure if it will continue in 2025 or if everyone who wants to come has now been, and realised how far it is, and we won’t see them again………

Most of my monthly goals have been successful in keeping me focussed on learning new things, meeting new people and making steady progress with challenges that might otherwise be easy to ignore. I am happy I know a lot more about the free food all around us (especially mushrooms and wild salad). I can definitely say I have done more outdoor swimming in the last year than in the rest of my life added together; managing to raise over £300 for charity in the process. Even better I have made new friends.

My plan to document our house renovation and possibly turn it into a self-published book, has started but as the progress is slow there doesn’t seem that much to write about. The longer it goes on, the less interested I seem to be in making the effort to turn it into something. I keep photographic records of everything we do to the house, so maybe my interest will re-kindle further down the line, but for now I am going to put this one on hold.

I will definitely have an art-related goal in 2025 and I think I will also focus on waste reduction. Now we have settled into a routine in our new home, it’s time to looking at ways to be a little bit more planet-friendly each month.

We have loved living the different seasons in our beautiful corner of Scotland, so I will leave you with some images of Galloway through 2024.

Wow … What a stunning selection of pictures !!

LikeLike

Thank you. We are fortunate to live in a beautiful corner of the world. I didn’t realise how many lands ape photos I took until I had to pick my favourites out of a year’s worth!

LikeLike

Thanks for another great blog update. Judging by your pension comment we’re the same age so you both are a bit of an inspiration for my future FIRE. I’ve taken a different route and am still funding the teenagers/young adults through education but following along with your adventure nonetheless. One day when I stop spending so much…

Seconding the feedback on the pictures – they are stunning.

LikeLiked by 1 person

I really enjoy your monthly updates and find your journey very interesting. Good luck and keep going. Best wishes.

LikeLike

Super photos. Interesting numbers – all looks well at this time, but market down years will crop up.

Spendy years happen; we had one in 2024 too. FWIW, I have never got on with the amortisation [outside the same year] idea/thing. Spending is spending in my book – the fact that is very lumpy is just how it is. Once you start introducing adjustments, you could inadvertently start to fool yourself. But that is just my view, and I know others disagree; some quite vehemently too!

I know that fear about watching numbers go down; I never found it easy to cope with. IMO, deaccumulation with the DB pension turned on is just far easier than with it switched off – but in numbers space there really should be no difference. There is just so much more to this than numbers though.

I think there might be a typo in your sentence about ISA’s And no, I did not try and reconcile your monthly updates with your yearly report – we all make those sorts of mistakes.

All the best for ’25 and will you still be pet sitting; if nothing else they oftentimes seem to take a very good photo!

LikeLiked by 1 person

We have a repeat housesit planned in the Isle of Man in the summer, but I think we’ll necessarily be ramping that down as we get more ties to home – chickens and a dog are planned eventually.

We haven’t decided whether to keep our Trustedhousesitters profile running for future holiday options or let it lapse entirely. It certainly is a cheap way to travel.

LikeLike

Thanks for sorting ISA sentence.

Another picky [numbers] editorial if I may, re “If we ‘earnt’ £134k, what did we spend?” I think (from looking at the graph) you might mean ‘gained 134k’, as I suspect you ‘earnt’ somewhat more, possibly: 134k plus (65.2k – 17.6k) = c. £182k or thereabouts, so around 15% up before any drawdown* [of c. 4%, ie 15% – 11%]. In any case, a very good year!

*your enumerated 4% SWR for 2024 (£53.4k) would be getting on for 4.5% I think; which is not good IMO

LikeLike

Thanks for pointing it out 🙂

You are quite correct with your other point. Earnt would have been more, but I don’t have the patience to work that out.

LikeLike

Fair enough. I only estimated it because your net gain number was spookily familiar and whilst we also had some drawdown last year I just wondered how we compared overall. From my fag packet calcs, you did better!

LikeLiked by 1 person