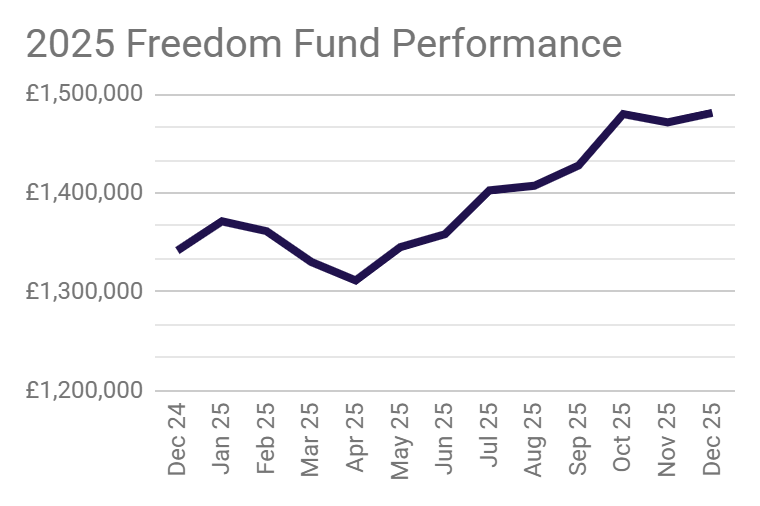

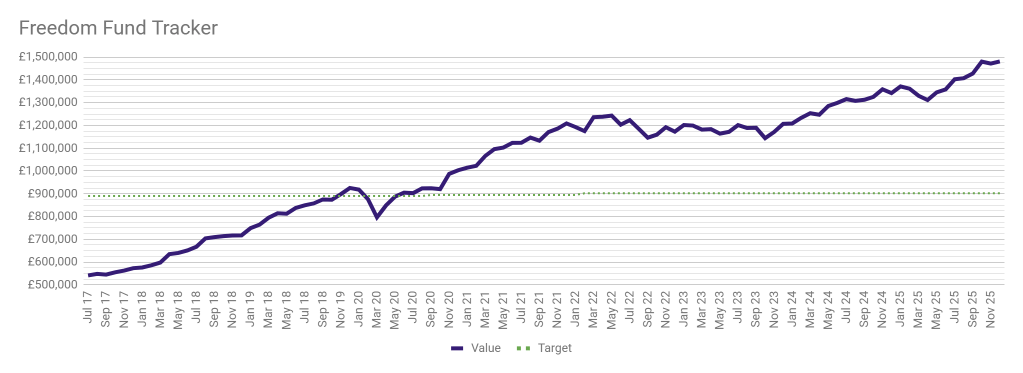

2025 definitely didn’t turn out as planned for a number of reasons, good and bad, but our freedom fund had a great year with no active tinkering whatsoever. One of my greatest fears when finally taking the plunge and quitting the 9-5 was large falls in the market in the first few years that we were relying on it for an income. Whilst we are probably not out of the danger zone yet, after 3 full years of early retirement (and not having a large side income from anywhere else), things are looking very healthy so far. While we were dealing with the ups and downs of life, the freedom fund finished 2025 with stellar gains on a year earlier.

We finished December £139,338 up on 12 months earlier, despite spending £31,879. In fact, drawdown from the fund was slightly higher than this, as we are lazy and like to keep it simple. In practice, we withdraw the same amount on the 1st of each month rather than varying it by spending. In 2025, I withdrew £2800 on the first of the month from my S&S ISA, and Mr Wombat did the same the following month, and so forth. On average we spent £2,656.61 a month (not including renovation costs) in 2025, so on average, we put around £140 a month towards the renovation project and only bothered to withdraw funds from property savings for the big expenses, or if there were a lot of smaller costs at the same time.

I have never been the kind of person who spends hours each month obsessing over the performance of my investments and making regular adjustments. Could the freedom fund have grown more if I had taken a closer interest? Possibly. I think it is equally likely that it would have performed worse, so I choose to stay very passive in my approach. I probably should have re-balanced asset allocation in my global passive portfolio more regularly than I did, during the accumulation phase. The only re-balancing I do now that we are drawing down, is to consider what to sell when the cash balance from dividend income alone is dropping a bit low.

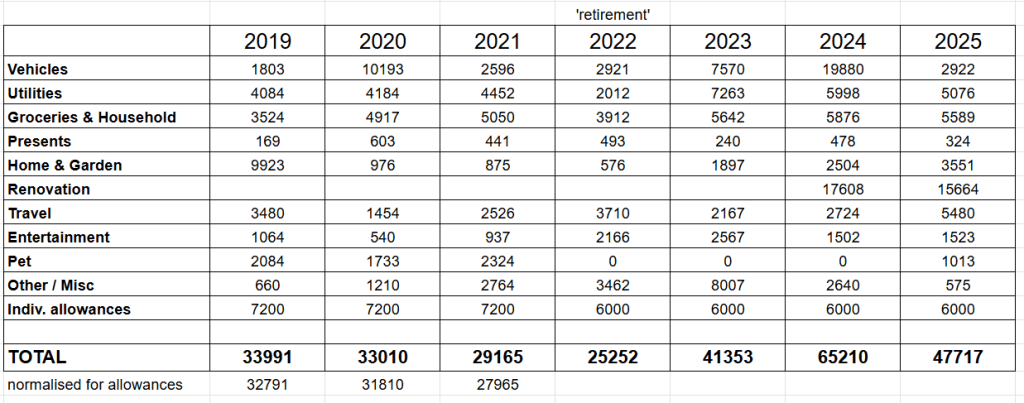

If the freedom fund has been doing well with very little action on our part, how did 2025’s spending line up?

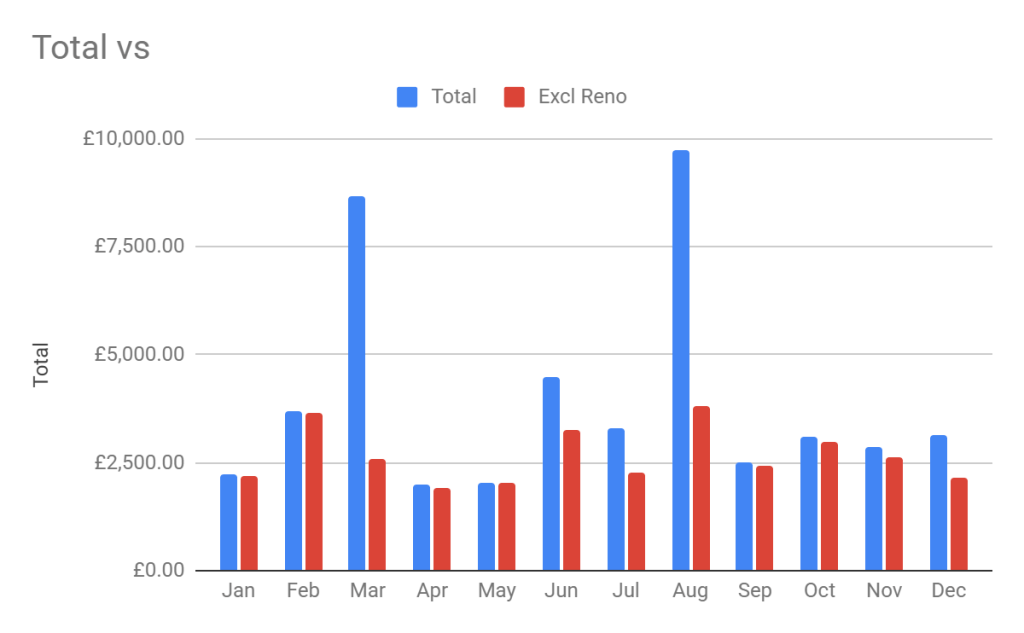

We spent a grand total of £47,717 in 2025, or £32,053 excluding one-off spending on the house renovation. A considerable drop on 2024, but then we didn’t buy a car. If we ignore the spending on the house project, our annual spending came in at 2.2% of the freedom fund or an average of £2,656.61 per month. Every year this percentage drops, the happier I will feel about the sequence of returns risk.

The higher months of spending (not including renovation – the red bars) largely coincided with travel, or paying for travel. Most categories of spending were broadly similar to last year. Travel was up, as was the home and garden category. Utilities went down despite price increases, and I suspect this was solely down to being away for at least 8 weeks over the winter, so reducing power usage and oil consumption. The drop in ‘miscellaneous’ spending I can only attribute to modifying the spreadsheet at the start of last year to better categorise costs which were becoming more frequent – like postage and tools. The latter probably explains at least some of the increase in the home and garden spending.

While our level of spending seems sustainable as a proportion of the freedom fund (for now at least), we do also need to keep an eye on the bridge from now until we can draw pensions and state pensions. Our ISAs continue to grow well despite being our sole source of income. When I sat down to work it out, I was pleased to see that in 2025 the value of our combined ISAs grew by £45k from £523,718 to £569,358 with no contributions, only regular withdrawals. We still have a sizeable cash buffer to prevent withdrawals during a serious market downturn. Lets see if 2026 is the year we need to start using it.

I have kept track of what rigidly adhering to the 4% rule would have meant for us in terms of available cash each year. If we had withdrawn 4% of the freedom fund in year 1 and then increased this amount by inflation every year, this is what we could theoretically have spent. I never felt confident that this approach would be sustainable, especially over such a long retirement period.

3 years in, by the 4% rule we should have been ‘safe’ to spend £58,701, rising to £60,579 in 2026. By staying well below this level we are quietly confident that our strategy isn’t going to collapse, but who knows what challenges life will throw at us. Have we been sensible or over-cautious? Is there a big change coming to trip us up financially? We have no dependents, so no need or desire to leave a legacy for anyone else, so the goal is not to die worth millions. The goal is to enjoy life on our own terms and have the freedom to choose how we spend our time, without worrying about how to pay for it. I think we have a good balance so far. I don’t feel as though we are missing out on anything by being too frugal, and the freedom fund seems healthy. The maths is working so far.

| ave inflation (CPI) | Annually | Monthly | |

| 4% of pot at ‘retirement’ Jul 2022 | 9.1% | £48,921 | £4,077 |

| Plus inflation 23 | 7.3% | £53,373 | £4,448 |

| Plus inflation 24 | 2.5% | £57,269 | £4,772 |

| Plus inflation 25 | 3.2% | £58,701 | £4,892 |

| Plus inflation 26 | £60,579 | £5,048 |

Outside the financials, 2025 taught us a few things. I have a lot more lime pointing practice under my belt and have definitely got faster. I branched out into stone wall repair and was pleased with the results. We both learned a lot about beekeeping through the local association, although we’re leaving getting our own bees until we are further along with the house project – now we know all the potential pitfalls and the costs involved!

I also know a lot more about probate and power of attorney processes, which, although not a pleasant topic, will equip me better for the future and the inevitability of dealing with ageing parents.

There was lots of travel last year, not least spending a month in California in Jan / Feb. The cost was brought right down by spending the first 3 weeks house sitting in San Diego. A short subsequent road trip to Death valley and Joshua Tree national parks was not cheap, but so worth it, while we were there. We also visited the Isle of Bute, Transylvania, Lake District and Helensburgh in 2025, plus a repeat house sit on the Isle of Man for home owners that we now consider friends. It was more travel than we planned, but part of stopping working was to be able to say yes to more opportunities. In 2026 we plan to be at home April-September to concentrate on the renovation, but we’ll see if anything presents itself that is too tempting to pass up……….

Although it didn’t feel like it at times, we made some good progress on the house. We ended the year with a heat pump instead of oil fired central heating and hot water via a Rayburn. We have 10kW of fully functioning battery storage and a 4.5kW solar array (although we may need to wait a few months to have fully functioning weather to really benefit from it). The upstairs ‘rooms in roof’ are now fully insulated and decorated and the ventilation behind is also much improved. The previously damp rooms downstairs are now one room, with original fireplaces revealed and the main bathroom is enlarged to allow us to have a separate shower. Although we didn’t make the progress we had hoped with these rooms in 2025, they are now dry. The living room now has central heating and improved insulation, but at the time of typing is still waiting to be decorated. 2025 also saw the re-roofing of a stone outbuilding and the erection of a fruit cage.

We may not be making speedy progress, but doing much of it ourselves has greatly reduced the cost of our project, and ‘slow renovating’ is now a thing – I’m on trend apparently😆 https://www.homesandgardens.com/interior-design/slow-renovating

When it comes to goals for 2026, we will definitely be focussed on finishing the downstairs of the house and reinstating the main bathroom. I want to make time to start painting again and do some experimenting with dry point etching. We will continue to be involved with the beekeeping association and monitoring our pine marten population for the Vincent Wildlife Trust. Despite having some broad themes of focus, I’m going to abandon monthly goals this year in favour of a more winging it approach. It’ll be interesting to see if it actually makes any difference to achieving what I hoped for.

Whatever your plans and goals for 2026, I hope you have hit the ground running and if not quite – what’s that first step to get on with this weekend? Roll on 2026, lets see what opportunities you have in store……